Mutf_In: Sbi_Infr_Dir_1lqgjku

Mutf_In: Sbi_Infr_Dir_1lqgjku exemplifies a strategic shift in financial infrastructure. Its innovative features prioritize operational efficiency and sustainability, addressing contemporary environmental concerns. The integration of modern design elements enhances user interaction, setting a new standard in the sector. However, as it navigates regulatory landscapes and technological advancements, the implications for stakeholders remain complex and intriguing. What challenges and opportunities lie ahead for this transformative initiative?

Innovative Features of Mutf_In

Mutf_In distinguishes itself in the financial landscape through a series of innovative features designed to enhance user experience and operational efficiency.

Efficiency and Sustainability in Infrastructure

A significant shift towards efficiency and sustainability in infrastructure is reshaping the financial sector's approach to resource management and environmental impact.

By integrating green technology, organizations can optimize processes, minimize waste, and enhance energy efficiency.

This transformation not only promotes ecological balance but also aligns financial objectives with sustainable practices, empowering stakeholders to make informed decisions that foster long-term viability and freedom from resource scarcity.

Cutting-Edge Design Elements

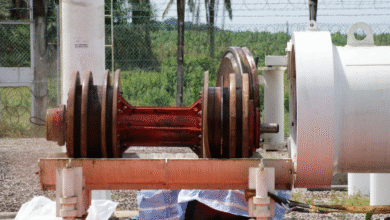

In the context of evolving infrastructure demands, the incorporation of cutting-edge design elements is becoming increasingly critical.

These innovations enhance aesthetic appeal while prioritizing user experience. By integrating advanced materials and ergonomic principles, designers create environments that are not only visually striking but also functional.

This shift towards modern design reflects a commitment to providing users with spaces that inspire freedom and foster engagement.

Future Implications of Mutf_In

As the landscape of infrastructure continues to evolve, the future implications of Mutf_In become increasingly significant.

Navigating regulatory challenges will be paramount for its success, as stakeholders adapt to changing policies.

Concurrently, technological advancements promise to enhance efficiency and sustainability.

The interplay between these factors will shape Mutf_In's trajectory, fostering innovation while ensuring compliance within an increasingly complex infrastructure environment.

Conclusion

Mutf_In: Sbi_Infr_Dir_1lqgjku exemplifies a pioneering shift in finance, harmonizing innovation with sustainability. While critics may argue that financial technology often prioritizes profit over ethics, Mutf_In challenges this notion by embedding environmental responsibility into its core operations. This commitment not only enhances operational efficiency but also resonates deeply with stakeholders who seek meaningful engagement. Ultimately, Mutf_In stands as a beacon of hope, demonstrating that financial advancement and ecological stewardship can coexist for a brighter, more sustainable future.